When renting out a property, repairs are inevitable. Whether caused by tenants, bad plumbing or intense weather conditions, as a landlord, you’re responsible for most of the repairs in your home. Over time, costs can start to add up rapidly, especially if you’re letting multiple properties.

For landlords looking to save some money, DIY repairs may seem tempting. But, when done poorly, these can cause complications down the line and may even require a professional to redo the work, costing you more money overall.

In 2022, we first surveyed UK landlords to explore the costs associated with maintaining and repairing a rental property. Now in 2024, we have rerun the survey to share the very latest facts and figures when it comes to being a landlord today.

Key findings include:

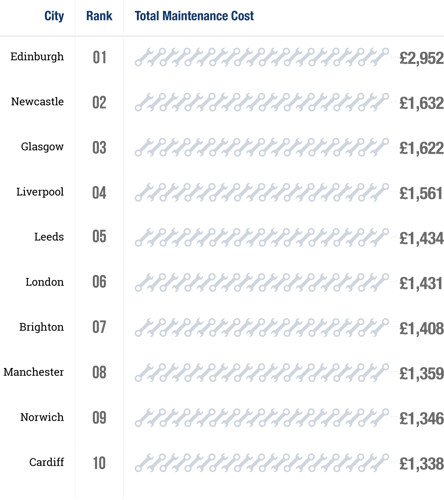

Landlord maintenance costs have increased 26.24%. since 2022 to on average £1,374.07 per year

Over half (59.80%) of UK landlords have had a dispute with tenants over who is responsible for property repairs or replacements, 10% more than in 2022

As little as 3.8% of landlords are unprotected, a fall from 20% in 2022